Occasionally on the blog, we like to direct you to interesting findings outside of our organization, and this New York Times article on the collection industry is too good to keep to ourselves. The title might lead on to what you can expect: Paper Boys: inside the dark, labyrinthine, and extremely lucrative world of consumer debt collection.

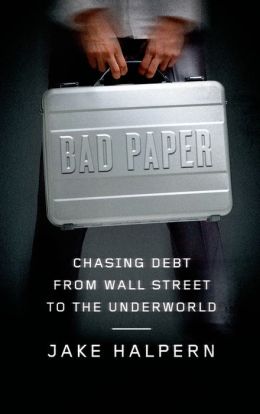

(Note: in support of his full-length book on this very subject, the author of the article, Jake Halpern, will be featured at the Texas Book Festival this weekend!)

Not only is it an interesting (and shocking) read, but it can clue coaches into the potential dangers that their clients face at the hands of collectors. It can also offer a little perspective from the other side of the table (or phone line), and alert us to scams and behaviors to watch out for. Knowing just how murky the industry is, it's our job to arm our clients against any abuses.

Now, that is not to say that all collection agencies can't be trusted, or that our clients should forgo paying out their debts out of fear. As coaches, it reinforces our need to take caution, and to send out those debt validation letters any time we intend to follow up with an agency. This article pairs well with a useful volunteer-created resource--our Credit Counselor Q&A--with Seth Mason of the great local organization (and referral for clients needing more hands-on assistance) Cornerstone Financial Education.

Enjoy!